- Various Chinese banks terminated their robo-advisory services in July 2022 following the shutdown of CMB’s Machine Gene Investment and ICBC’s AI Investment

- Heightened regulatory scrutiny on fund investment advice in China led to the termination of bank-owned robo-advisors

- Several investors still hesitate to adopt robo-advisors because of its ‘black box’ nature

Various Chinese banks terminated their robo-advisory services in July 2022 following the shutdown of CMB’s Machine Gene Investment and ICBC’s AI Investment

After suspending the purchase function for all investible assets in December 2021, CMB announced on 25 June 2022 that it would stop its Machine Gene Investment service.

Since 1 July 2022, the robo-advisory service was no longer searchable on the bank’s mobile application. Core functions within the service like purchase, investment position adjustment, and performance display were no longer supported; existing CMB robo-advisory clients could only redeem their funds.

Machine Gene Investment was the first robo-advisory service launched by a Chinese commercial bank, back in December 2016. Until the purchase function was suspended in December 2021, it remained one of the largest bank-owned robo-advisory services in China with total investment of more than $1.9 billion (RMB 14 billion) and 200,000 customers. According to CMB, all 30 investment portfolios generated by its robo-advisor achieved positive returns with annualised rate of return of between 8% and 15%.

ICBC terminated its robo-advisory AI Investment on 30 June 2022 in compliance with regulatory requirement. Ping An Bank’s Ping An Zhitou, meanwhile, was no longer searchable on the its mobile application as of December 2021, although existing clients still had limited access to redeem their funds.

Other major banks that ceased robo-advisory operations last year were China Construction Bank, Shanghai Pudong Development Bank, CITIC Bank, China Guangfa Bank and Bank of Jiangsu. To date, none of the banks have resumed these operations.

Heightened regulatory scrutiny on fund investment advice in China led to the termination of bank-owned robo-advisors

Chinese banks implemented robo-advisory service as early as 2016. Kong Xiang, chief financial industry analyst at CIB Research, said early bank-owned robo-advisory services in China were primarily engaged in providing automated investment strategy on a range of assets, mostly public fund products and bank-issued wealth management products, on top of fund sales.

As fund products comprise a large portion of investment portfolios, a fund investment advisory licence is a prerequisite to operate robo-advisory services in China.

ICBC, CMB and Ping An Bank, were the only participating banks in the pilot programme for fund advisory business initiated by the China Securities Regulatory Commission (CSRC) in 2019. However, they were not granted the licence to engage in fund advisory services. Since then, no licence has been awarded to any bank.

The shutdown of bank-owned robo-advisory services in July 2022 was a direct response to a piece of regulation on fund investment advice issued by China Securities Regulatory Commission (CSRC) in late 2021.

According to the Notice on Regulating Fund Investment Advice Activities, institutions without fund investment advisory qualifications—all Chinese banks and other non-licensed fund sales platforms—must stop fund investment portfolio strategy advice services before 30 June 2022.

The Notice stated: "Some institutions have confused the fund investment advisory business with fund investment advice activities that are supplementary to fund sales business." Licensed institutions like brokerages and fund companies were not affected by the regulation.

According to research from Ping An Securities, as of June 2022, 43 out of the 60 financial institutions on the pilot programme were able to officially launch their fund investment advisory business. These comprise 20 fund companies, 20 brokerages and three third-party sales platforms.

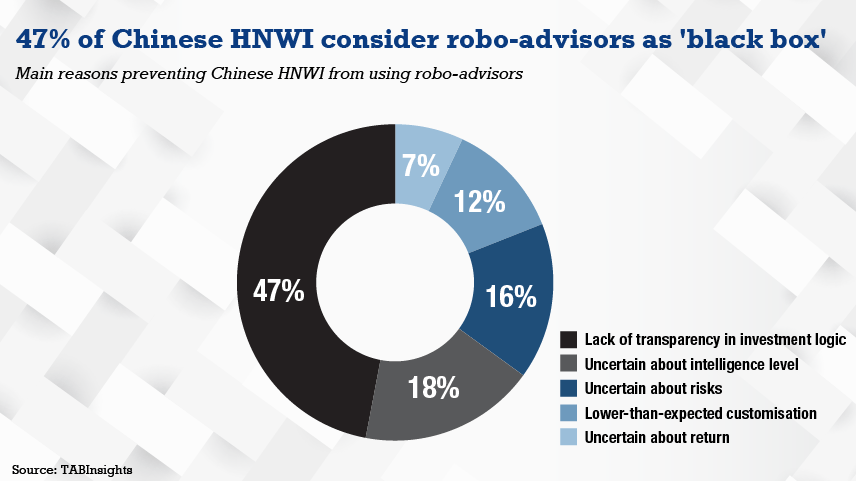

Several investors still hesitate to adopt robo-advisors because of its “black box” nature

Since the launch of new asset management regulations in 2018 and subsequent implementing rules, Chinese wealth managers were under increased regulatory scrutiny. The suspension of bank-owned robo-advisory services yet again indicates the regulator’s focus on addressing the fiduciary and competency concerns in this area. It also signals the importance of licensing in the robo-advisory business.

In the United States, the regulation around robo-advisors is in a similar situation. According to the U.S. Securities and Exchange (SEC): “Robo-advisers, like all registered investment advisers, are subject to the substantive and fiduciary obligations of the Advisers Act.”

Jiang Han, senior researcher at Pangoal Insitution, said the current shutdown of bank-owned robo-advisors is seen as a regulatory move for investor protection. In the future, with the improvement of artificial intelligence (AI) technology and the optimisation of regulation, it is possible that better robo-advisors will come on board.

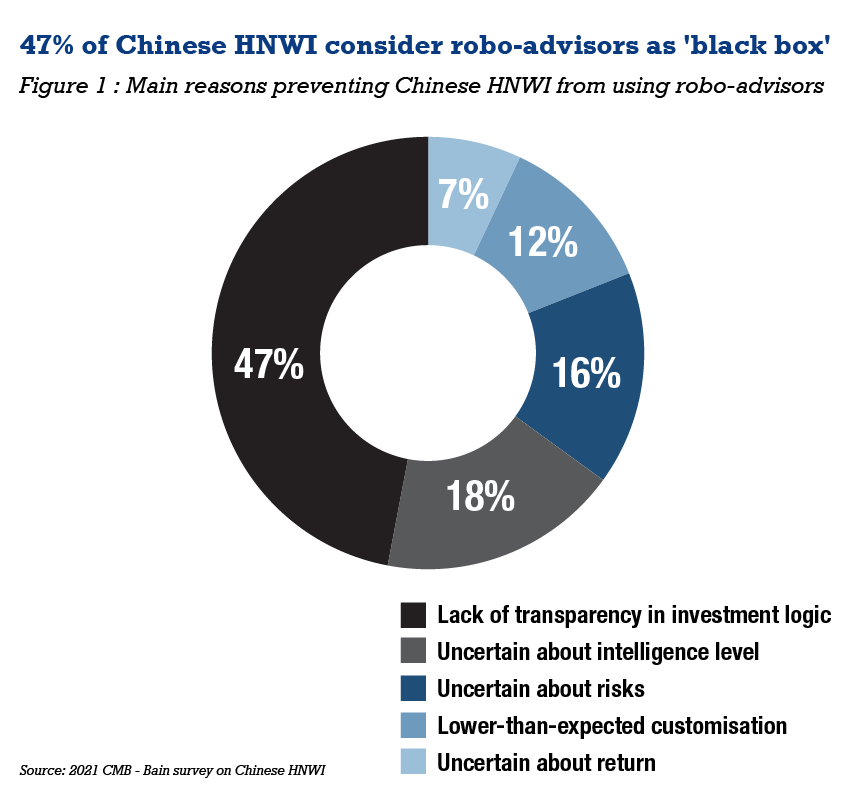

Besides technology and regulation, the biggest hinderance for the wider adoption of robo-advisory services lies with the investors. According to a survey in 2021 by CMB and Bain Company on Chinese high net-worth individuals (HNWI), 57% of the overall responders have never used robo-advisory services. Their main roadblock was “lack of transparency in investment logic”, together with uncertainties about risk and return, lack of clarity over intelligence level, and not having options for customisation.

The survey results reflect the perennial ‘black box’ perception of robo-advisors among investors worldwide. The recent allegation that Charles Schwab, the largest publicly traded US investment services company, used robo-advisory service for “egregious” allocations of client money that incurred hidden costs has only increased the distrust in robo-advisors.

The emerging field of explainable AI (XAI) may help robo-advisors navigate transparency and trust issues among users. It could also assure the regulator that AI processes and outcomes of robo-advisors are reasonably understood by bank employees and investors.

Optimising investor education on robo-advisory, according to Professor Guo Li at Peking University, is also crucial. Investors should be educated on conflict of interest, algorithms involved in robo-advisory, and also reminded of potential risks.

As for Chinese banks’ implementation of robo-advisories, a senior manager from one of China’s four largest banks told The Asian Banker that until regulation becomes clear, bank-owned robo-advisors will be used internally to assist human wealth advisors in providing professional investment advices to investors.

.webp)

.jpg)